US Mortgage Rates Fall Amid Bank Failures

Mortgage interest rates have dropped for US home buyers, following a tumultuous few weeks for the country's banking sector.

Facts

- Mortgage interest rates have dropped for US home buyers, following a tumultuous few weeks for the country's banking sector.1

- The Mortgage Bankers Association (MBA) said on Wednesday that interest rates on US home loans had lowered by the most in four months last week, after investors flocked to safer government bonds following Silicon Valley Bank’s collapse.2

- Mortgage rates are typically linked to government Treasury bonds, so when increased demand for the latter drove their returns down, mortgage rates also declined. 30-year fixed mortgage rates fell to 6.125% from 6.490%, while 20-year fixed mortgages dropped to 5.875% from 6.125%. Meanwhile, mortgage refinancing rates rose for those respective terms.3

- However, in a bid to tackle the ongoing crisis of high inflation rates, the Federal Reserve on Wednesday announced a rise in the benchmark interest rate by a quarter of a percentage point to a range of 4.75% to 5% — its ninth consecutive rate rise which brought it to the highest rate since 2007.4

- The rise will increase the cost of borrowing and is likely to dampen the trend of lower mortgage rates seen in recent weeks. It will also raise the cost of personal loans and credit card bills, as well as the overall expense of other larger purchases such as auto loans.5

Sources: 1Yahoo News, 2Reuters, 3FOX News, 4Guardian, and 5The Motley Fool.

Narratives

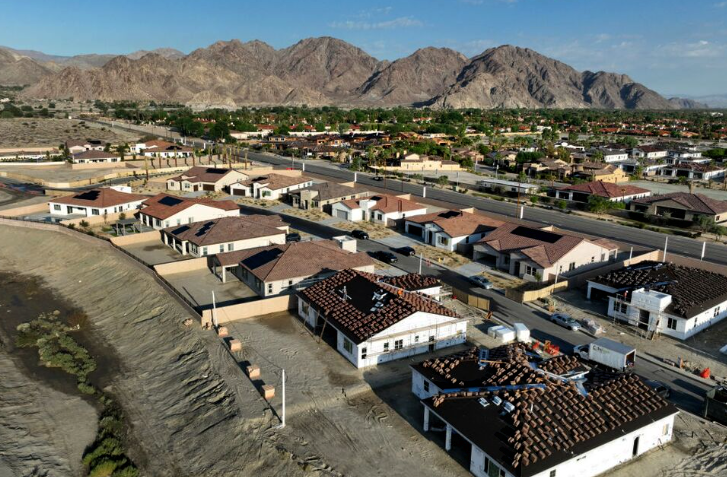

- Narrative A, as provided by Bloomberg. While many are rightfully worried about the economic future of the US following major banking collapses, the housing market is offering reason for optimism in the economy. Americans are lining up to buy homes and reduced mortgage rates are enabling more people to become homeowners. Home builders are also benefiting from an emerging boom as the economy shows life.

- Narrative B, as provided by USA Today. The housing market’s steep reaction to Fed policy is more a cause for concern than it is a reason for optimism in the economy. The housing market is overly sensitive to the Fed’s actions, and is showing signs of immense volatility. It is hard to gauge the true housing market independent from the Fed, but it seems like we are heading towards a housing bubble.