Bank of Canada Cuts Rate by 50 Points

The Bank of Canada (BOC) reduced its benchmark interest rate by 50 basis points to 3.25% on Wednesday, marking the fifth consecutive cut since June and bringing total reductions to 175 basis points in 2024.

Facts

- The Bank of Canada (BOC) reduced its benchmark interest rate by 50 basis points to 3.25% on Wednesday, marking the fifth consecutive cut since June and bringing total reductions to 175 basis points in 2024.[1][2][3]

- BOC Gov. Tiff Macklem indicated that future rate cuts would follow a more gradual approach, as monetary policy no longer needs to be "clearly in restrictive territory" with inflation holding steady at the 2% target.[3][4]

- The Canadian economy grew by only 1% in the third quarter, though it's up by 1.5% from a year ago. Meanwhile, unemployment rose to 6.8% in November, up from 6.5% the previous month.[1][5]

- The central bank acknowledged that reduced immigration targets announced by the federal government suggest GDP growth in 2025 will be lower than previously forecast in October.[6][7]

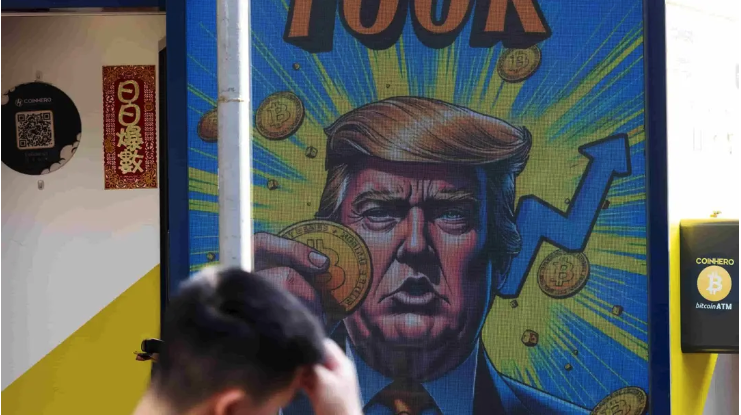

- Macklem identified incoming US President Donald Trump's threat of 25% tariffs on Canadian exports as a "major new uncertainty" that could significantly impact the economic outlook.[4][5]

- Prior to the BOC's announcement, the Canadian dollar sat at a four-year low of 70.5 cents to the US dollar. Following the rate cut, it saw an uptick to 70.75 cents to the US dollar.[1][6]

Sources: [1]The Globe and Mail, [2]National Post, [3]Yahoo Finance, [4]Al Jazeera, [5]The Wall Street Journal, [6]Financial Post and [7]Bank of Canada.

Narratives

- Left narrative, as provided by Bank of Canada and The Globe and Mail. With inflation at 2% and rate cuts boosting household spending, Canada’s economy remains resilient. Despite slower GDP growth and softer job markets, the country's fundamentals are strong, including a rise in companies hiring workers. Historically, Canada has weathered US tariff threats, including Trump’s exaggerations and provocations. Bilateral economic integration ensures Canada will withstand such pressures while maintaining stability.

- Right narrative, as provided by YouTube and National Post. Trudeau's government continues to gaslight the country into thinking his money-printing schemes aren't destroying the economy. The budget deficit is also about to worsen as the Liberals introduce costly measures like GST and HST waivers, projected to cost over $1.5B, and $250 checks that will cost over $4B. Between shrinking economic growth and a bloated budget, Trudeau has a duty to call an election so the people can voice their grievances.